-

- Market conditions hit all-time highs on gold

- Mental battle between discipline and FOMO

- Learning curve with Magic Keys trade management

Trading Summary:

Today marked my third day in the Dominion Funding Challenge, and I’m learning that success isn’t just about profitable trades – it’s about maintaining discipline. I ended the day up 0.02%, bringing my total challenge progress to 0.74%, but the path there wasn’t as clean as I’d have liked.

Key Trades:

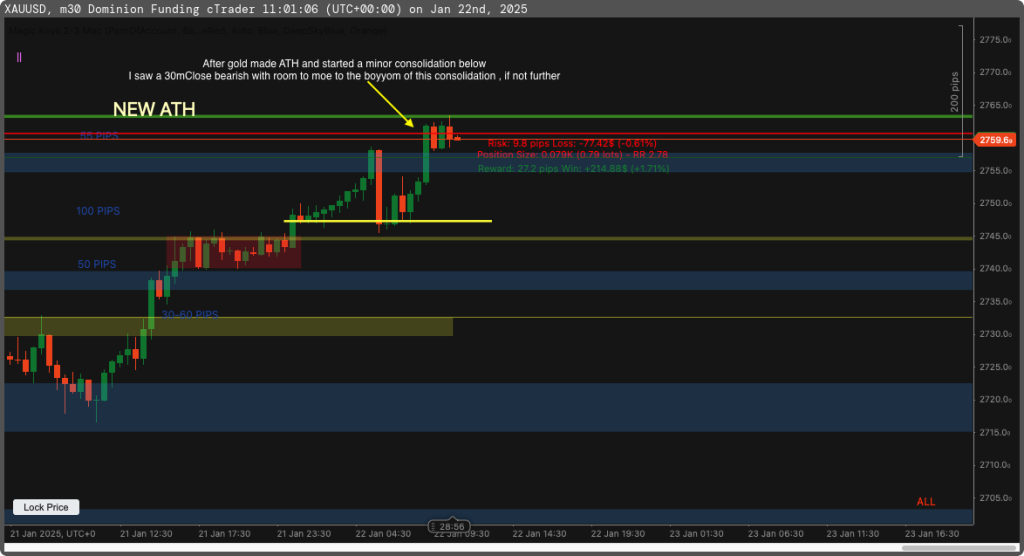

Trade #1 – Gold Sell 🤩

-

- Entry based on bearish 30-minute close

- Secured 18 pips profit

- Used Magic Keys for quick execution

- Profit: $75

Gold Sell Re-entry

-

- Same setup, better entry point

- Break-even exit

- Profit: $0.34

Trade #2 – GJ Sell (Where Things Got Messy)

-

- Entered in a compressed 30-pip range

- Failed to respect range limitations

- Loss nearly wiped out earlier profits

- Loss: -$54

Trade #3 – Gold Buy

-

- Saw confluence with HTF & LTF market structure

- Entered on bullish close at 30m support level

- Entered too small with auto position sizing

- Mistakenly closed early for 8 cumulative pips (between positions)

- Profit: +$15

Gold buy Re-entry

-

- Realizing I entered too early but the move was still early as well

- Re-entered on the 5m close

- Exited a bit hastily at notice of 5m resistance and because self awareness of overtrading.

- Profit: +$22

Trade #4 Gold sell/Buy 😓

-

- This range was too tight to trade.

- Counter trend trade. HTF & LTF are bullish.

- 🛑 I TOOK OF MY S/L. Yes and I’m not proud.

- Performed a hedge buy to get myself out of the deep loss.

Gold HEDGE buy

-

- Entered a buy as price reversed with momentum

- Closed the first sell ASAP

- Ended up wiping out most of the $170+ loss with that buy

- Combined Loss for sell + buy: -$56.68

The Magic Keys Difference:

I’ve got to give credit where it’s due – Magic Keys made trade execution notably smoother today. Despite my overtrading, having preset risk parameters and quick execution buttons helped prevent catastrophic losses. However, I discovered I need to adjust my settings for more consistent position sizing.

Lessons Learned:

1. Stick to Two Trades Per Day

My biggest mistake was breaking my two-trade rule. Even though some later setups looked promising, overtrading led to diminished decision-making quality.

2. Position Sizing Matters

I realized my Magic Keys settings were giving me smaller position sizes than intended. While this accidentally protected me today, I need to adjust these settings to match my regular risk parameters.

3. Range Awareness

The GJ trade was a prime example of forcing an entry in a compressed range. Halfway through a 30-pip range should have been an immediate red flag.

Mental Game Notes:

The irony isn’t lost on me that just hours after declaring “I need to stop overtrading,” I continued to take positions. It’s a humbling reminder that trading psychology isn’t about knowing what to do – it’s about actually doing it.

Risk Management:

Despite breaking several rules, my core risk management principles remained intact, preventing any notable account damage. Current challenge stats:

- Account Balance: $12,500

- Current P&L: +0.74%

- Progress to 10% Goal: 7%

Tomorrow’s Game Plan:

1. Adjust Magic Keys settings for consistent position sizing

2. Strictly enforce two-trade maximum

3. Focus exclusively on clear, high-probability setups

New Mantra: “Give thanks for the W and keep going.” This simple phrase will help combat greed, revenge trading, and FOMO.

Trading Tools Highlight:

Magic Keys continues to prove its worth, particularly in quick execution and position management. Despite my overtrading today, having preset risk parameters and quick execution buttons helped maintain some discipline in position sizing. For newer traders looking to improve their execution, I highly recommend checking out Magic Keys.

Final Thoughts:

Today was a reminder that profitable trading isn’t just about catching good moves – it’s about consistently following your rules. While I’m grateful to end the day in profit, I know I need to tighten up my discipline. There’s no time limit on this challenge, and rushing won’t help me reach my goals.

Looking forward to coming back tomorrow with renewed focus and discipline. Remember, the market isn’t going anywhere – patience and consistency will win this race.

Stats for Day 3:

-

- Total Trades: 4 (2 more than planned)

- Winning Trades: 2

- Break-even: 0

- Losing Trades: 2

- Net Profit: +0.02%

- Cumulative Challenge Progress: +0.74%