Early Morning Market Analysis

Starting my Dominion Funding challenge trading session at 5 AM, I immediately noticed gold’s strong bullish structure across multiple timeframes. The daily, 4-hour, and hourly charts all aligned to show upward momentum, giving me confidence in looking for long positions.

Trade Entry & Execution

After identifying key support levels, I waited for price action confirmation before entering. The 30-minute timeframe showed a clear bullish structure with higher lows forming. Using Magic Keys for precise execution, I entered a long position when price respected the previous swing low.

Position Management Strategy

My initial trade management followed a structured approach:

- Closed 85% of position at 22 pips for $93.76

- Took partial profits on runner at 50 pips for $19.64

- Final runner portion closed at 64 pips for $25.65

- Total profit: $138.95 (>1% account growth)

Key Trading Insights

Today’s session reinforced several vital trading principles:

- Higher timeframe alignment matters

- Patience in waiting for setup confirmation pays off

- Position sizing and partial profit taking helps maximize gains

- Magic Keys streamlines execution and risk management

- Clean market conditions make trading easier than volatile periods

Feeling Optimistic

I started my trading session with clear intentions – maintain discipline and wait for high-probability setups. Gold showed significant volatility early in the session, presenting both opportunities and challenges. Using my Magic Keys trading tool helped me calculate risk precisely, a massive improvement from my early days of manual calculations.

As I continue the Dominion Funding challenge, maintaining discipline and following my trading plan remains essential. Today’s success came from patience and proper trade management rather than overtrading or forcing setups.

The markets are showing excellent trending conditions, particularly in gold. These conditions, combined with my improving trade management, give me confidence in completing the challenge successfully.

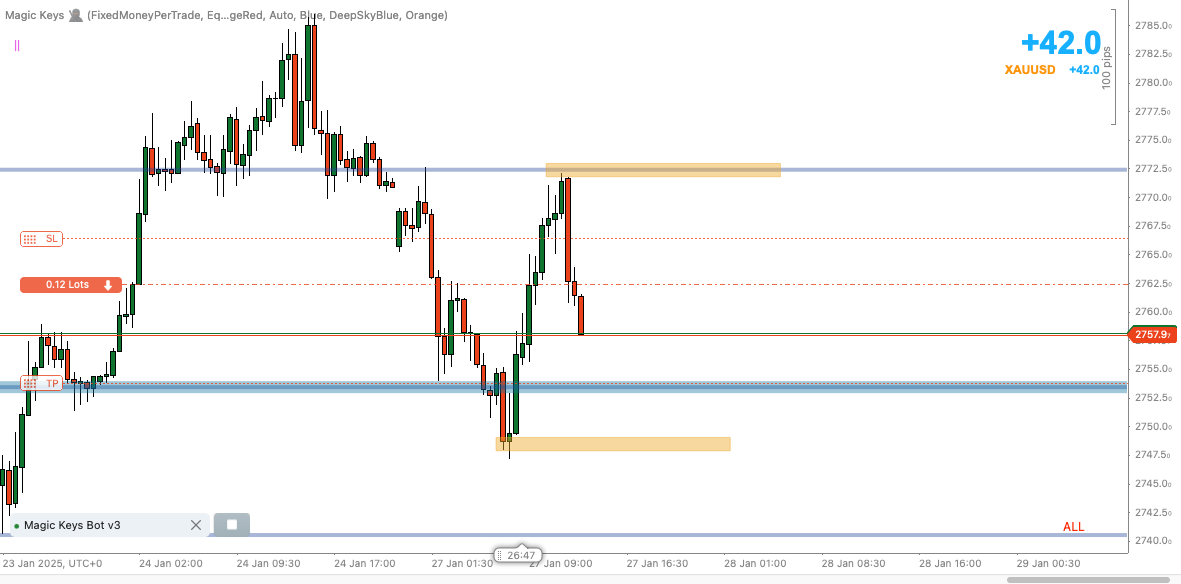

Second Trade Execution & Analysis

- Second trade showed promise with 42 pip gain before retracing

- Risk management kept losses minimal despite market reversals

The beach taught me an important lesson yesterday while skimboarding – trading is all about waiting for the perfect setup. Just like you stand on the shoreline watching smaller waves pass by until the right one comes, trading requires that same patient observation. When I saw gold’s bearish momentum building after a retracement, I knew it was time to execute.

Trading Psychology & Position Management

My biggest lesson today came from not securing profits when they were available. Having 42 pips in profit on my second trade but letting it turn into a small loss reinforced the importance of taking partial profits. The market doesn’t care about our expectations – it does what it does.

Challenge Progress Update

Despite the mixed results on individual trades, I’m pleased with today’s performance:

- Account grew by 1.02%

- Total P&L: +$347

- Overall challenge progress: 2.78% toward 10% goal

Using Magic Keys continues to be a game-changer for my trading. The ability to quickly calculate position sizes and manage risk has dramatically improved my execution. For any traders looking to upgrade their trading toolset, I highly recommend checking it out.

As I continue this funded account challenge, each day brings new insights. Today reinforced that success comes not from hoping for home runs, but from consistent execution and disciplined risk management.

Early signs are encouraging – at this pace on a funded $100k account, the potential for $2k+ weekly returns looks achievable. But first, I need to maintain focus on completing this challenge successfully.

Tomorrow brings new opportunities. I’ll be back at my charts, waiting patiently like a skim boarder for the perfect setup.